Under the Hood

How we're building AI that thinks like a finance professional, not just talks like one.

We've all been there. Early in my career, as a junior analyst, I was involved in evaluating a fleet operating company plying intercity buses. We began our client discovery meetings by looking at headline numbers and doing back-of-the-napkin calculations. The company had a very healthy EBITDA and a great ROCE— a seemingly robust asset-heavy business. As the genius analyst I thought I was, I dutifully spent hours building a five-year financial model to project returns for a potential investor.

But the numbers weren't adding up. The 5-year IRR was DOA. So, I ditched the fancy model and went back to the fundamental driver of the business – economics of a single bus. That's when it hit me. When you're past the median age of your assets, ROCE can look a lot better on paper than it is in reality. I should have started my work with NPV and IRR calculation for a single asset and built my projections from up there.

Every finance professional has a story like this. We learn our skills in the trenches, not from a textbook. That's why we at Straticent aren't just putting a fancy wrapper with a cool UI/UX on a large language model. Our product vision is guided by two principles:

- Finance professionals (like most knowledge workers) will be valued for their expertise, outcomes, and for standing by their recommendations. Think about it: we don't need a doctor to prescribe Metformin for Diabetes, Chatgpt is enough, but we won't trust ChatGPT with a diagnosis; we go to the doctor for their experience and professional stamp of approval. In finance, your name on a recommendation is everything. That's why an audit trail and clear visibility into our reasoning engine's recommendations are non-negotiable.

- AI needs to think like a professional, not just talk like one. We've all spent years in the trenches—analyzing, reporting, and getting our work critiqued. That's how have finance professionals have honed their skills. So, an AI needs to mimic this thought process to truly augment a professional's capabilities.

To achieve both the above, we are building a proprietary reasoning layer—a dynamic decision-making tree built specifically for finance. This self-learning intelligence layer works with LLMs, which are great at NLP inference. The result is a hybrid AI system where our financial intelligence layer leverages LLMs for easy inputs and feedback, all within a UI that provides a clear audit trail and a custom feedback engine. The goal is a personalized intelligence layer that learns and improves as you use it.

Why is this relevant?

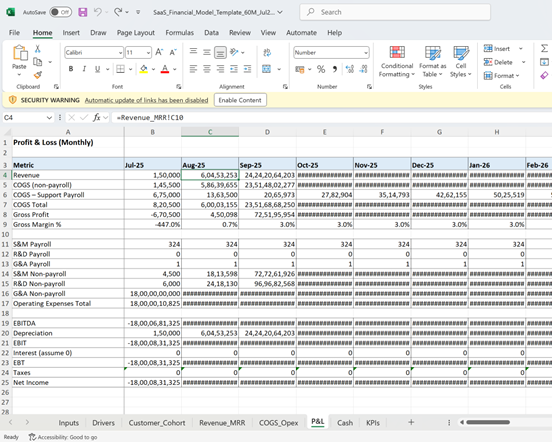

LLMs are great chatbots but aren't yet at the level of expertise you can rely on for a board presentation or confident pricing discount decisions. While foundational models are building reasoning through reinforcement learning, their fundamental modus operandi is still next-token prediction. You can break down a task, like forecasting a financial model for a SaaS company, into multiple steps—breaking down revenue into volume and pricing, then breaking down volumes into new and returning customers, etc but this often just creates a neat prompt library. This is why LLMs still produce something like this – which are not ready to be used in a business context.

While LLMs may evolve to have intern-level expertise, they're unlikely to be useful for a CFO or a CPA advising a client. They lack the nuanced financial dynamics of specific industries—like healthcare—which aren't available as training sets. At Straticent, we rely on our own intelligence layer (a decision-making tree combined with industry-specific data) to provide the context and accuracy that professionals can confidently rely on.

Keep following us to understand our roadmap and the outcomes we are striving towards.

Ready to Experience Straticent?

See how our AI reasoning layer can transform your financial analysis workflow.